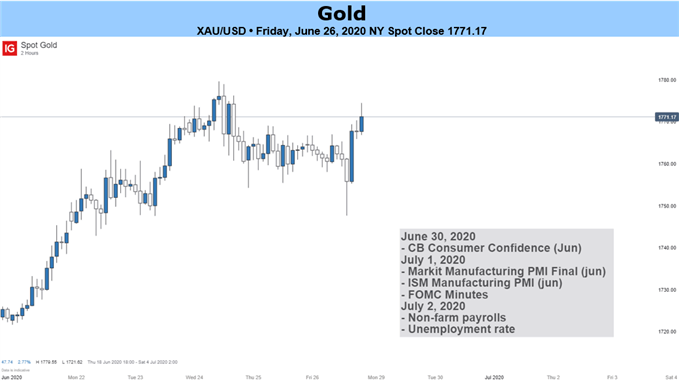

Gold prices have recently broken out above a key level at US$ 1,750 and edged higher. Global growth uncertainties resulting from the coronavirus and concerns over the economic recovery is inhibiting risk appetite and boosting demand for safety.

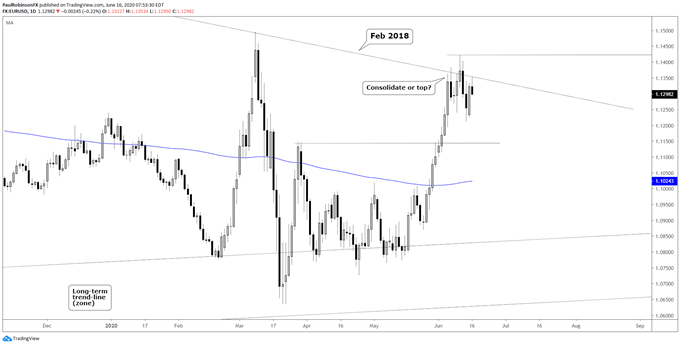

The EUR/USD rally since last month is at risk of failing, in-line with how it has behaved since early 2018. Rallies have been unable to hold for more than a week or so once they became extended. If price can maintain around trend-line resistance, then a change in character could be underway.

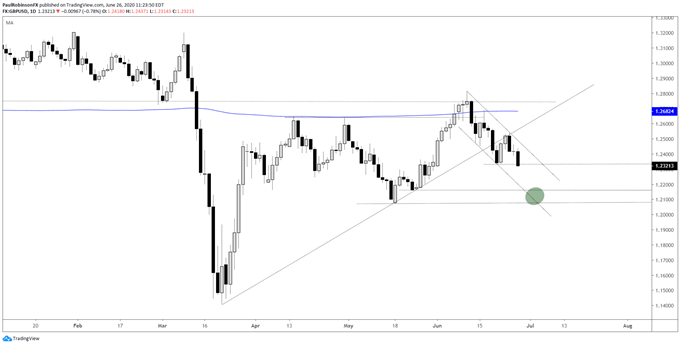

GBP/USD broke the sturdy March trend-line last week, and then retested the broken threshold. The sequence has price heading lower within the confines of a channel off the recent high. Looking lower, a break below 12335 will put Cable at risk of sinking towards the next area of support under 12200.

The downtrend off the month high looks poised to continue, with potential for a material drop in the days ahead. On the week ending June 19, GBP/USD broke the trend-line from the March low, putting it into a vulnerable position.

The technical outlook for USD/JPY highlights the potential for a broad based recovery in the Japanese Yen as both price and the Relative Strength Index (RSI) snap the upward trends from earlier this year, but the exchange rate may stage a larger recovery going into July as it reverses ahead of the May low (105.99).

Turmoil in equity markets continued last week as the Dow Jones, S&P 500 and even the Nasdaq slipped lower. While losses were more gradual than two weeks ago, the consistency with which stocks have fallen from their June peaks has seen the Dow Jones etch a concerning series of lower highs.